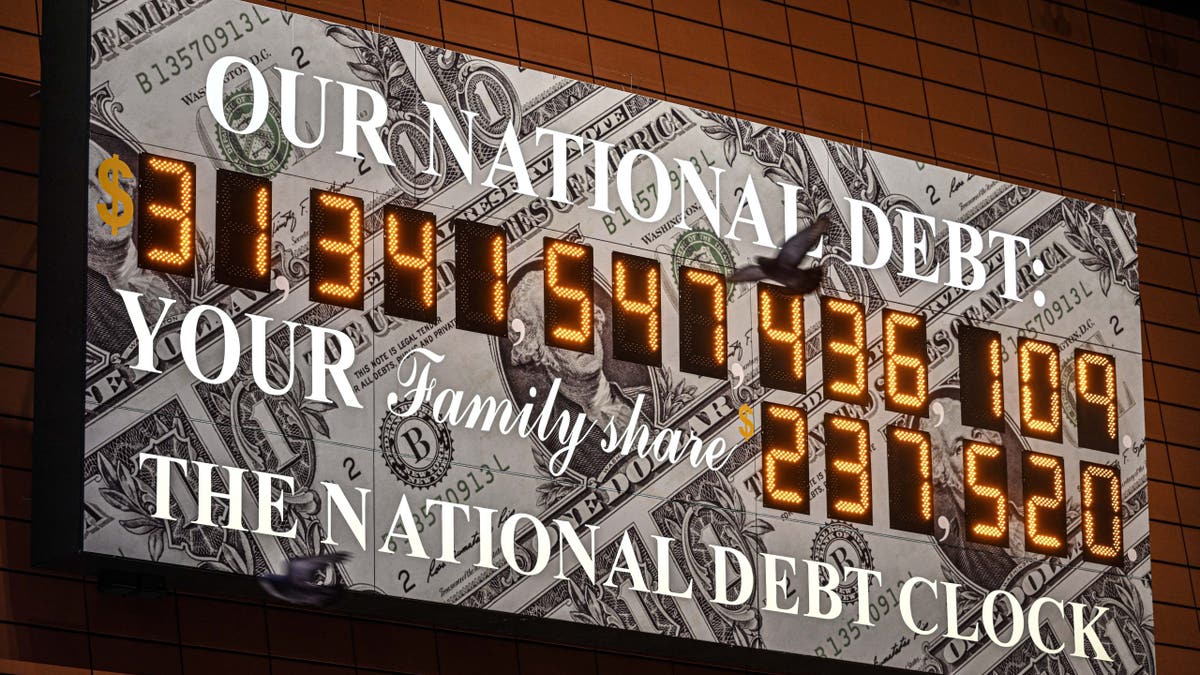

Facing a mounting national debt exceeding $36 trillion, the U.S. Congress needs innovative revenue solutions to fund President Trump's agenda and avoid escalating deficit spending. Here are four proposals to generate trillions in one-time revenue and billions in ongoing revenue without resorting to income tax hikes:

1. Roth IRA Conversion Incentive:

Americans hold over $37 trillion in untaxed retirement savings in 401(k)s and traditional IRAs. Congress could offer a one-time window for converting these funds to Roth IRAs at a flat tax rate (e.g., 10-15%). This would generate immediate revenue while allowing savers to manage their future tax burden.

Image: National debt clock display (Photo by Fatih Aktas/Anadolu Agency via Getty Images)

2. Asset Liquidation:

The U.S. government possesses substantial land and spectrum resources. Auctioning off portions of these assets could generate significant revenue while boosting national productivity.

3. Federal "Sin Taxes":

With the increasing legalization of marijuana and online gambling at the state level, Congress could impose federal taxes on these transactions. This would preempt state revenue streams, directing funds to the federal treasury while potentially discouraging these activities.

4. Federal Workforce Reduction:

Congress could authorize a 10% reduction in the federal civilian workforce, bypassing existing laws and regulations. This would generate substantial savings by streamlining government operations.

These four measures offer creative solutions for addressing the national debt without increasing the burden on taxpayers. They represent a starting point for a much-needed conversation about fiscal responsibility and innovative revenue generation.

Comments(0)

Top Comments