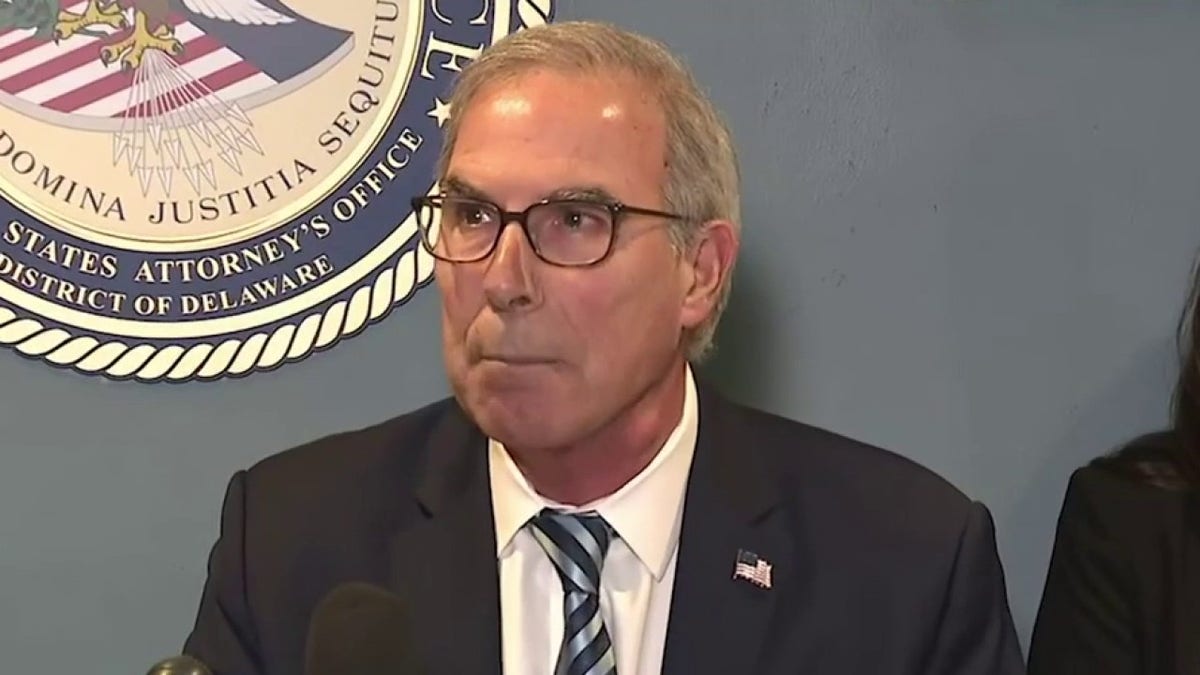

A recent report from Special Counsel David Weiss reveals the extent of Hunter Biden's tax evasion, detailing how he leveraged his family name and connections for substantial financial gain while failing to pay over $1.4 million in taxes between 2016 and 2020. Weiss's report paints a picture of conscious and willful tax avoidance, highlighting Biden's lucrative business dealings in Ukraine and China, where he secured positions and contracts yielding millions of dollars for minimal work.

The report underscores that Biden's failure to pay taxes wasn't a simple oversight but a deliberate choice, fueled by an extravagant lifestyle. Despite having the means to settle his tax obligations, he prioritized personal spending, knowingly submitting false business deductions and misleading his accountants. Weiss explicitly dismisses Biden's past drug abuse as an explanation for his tax evasion, pointing to the timing of his false 2018 return filed well after he achieved sobriety.

The report also criticizes President Biden's pardon of his son, specifically challenging the President's characterization of Hunter's prosecution as "selective" and "unfair." Weiss contends that these statements are not only baseless but also detrimental to public trust in the justice system. He argues that such politically charged accusations undermine the integrity of career prosecutors and public servants who make difficult decisions in good faith.

Hunter Biden's attorney, Abbe Lowell, disputes the report's findings, claiming that it overlooks key aspects of the seven-year investigation, including Weiss's initial proposal for a lesser charge resolution and the pursuit of unsubstantiated conspiracies. Lowell portrays the investigation as a case study in the misuse of prosecutorial authority.

The release of Weiss's report to Congress concludes the lengthy investigation into Hunter Biden, leaving lingering questions about the intersection of political influence and legal accountability.

Comments(0)

Top Comments